Update: Apparently due to high demand, anyone who signs up for Ritual from 2nd April onwards will not receive the £1 meal deal. You can still get the free £10 credit though.

It’s been a while since I’ve last posted, but this is a pretty good offer: if you download Ritual, a food collection app, you can get up to five free meals.

The restaurant choices on the app (at least for Canary Wharf) are pretty varied – there’s large chains like Nando’s and Wagamama, smaller chains such as Chop’d and Crush, and Yum Bun and Pastaio in Giant Robot. There’s also a few coffee shops, but you’ll get your money’s worth with the larger meals!

To sign up, click this link and download the app. It appears that you get £5 off your first meal, so feel free to add £4 of extra stuff to your initial order (drinks, sides, etc.), then you can use your second £5 credit over your next few orders [you’ll need to put your credit card details in at this point], making them free.

You can only order one £1 meal per day, and each of the meals is pre-selected (e.g. 1/4 chicken at Nando’s with two sides of your choice). I’d advise getting your order in early (11:30am), as there’s been pretty big demand due to the offer: if they get too busy, they may run out of the promotional item, or simply stop taking orders.

Additionally, if you get your colleagues to go to the same restaurant, you can offer ‘pickup’, which gets you a few more points (50p worth) for bringing back food from the same restaurant for your floor.

Disclosure: if you sign up using my link, I get 1,000 points, equal to £1 of free credit, but you also receive £10 in free credit too. If you don’t use a promo code, I believe you won’t receive the free credit, so it’s in your interest to use a referral.

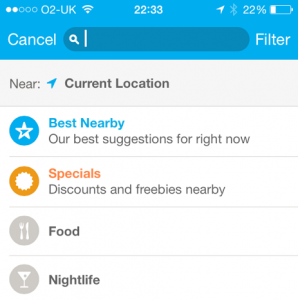

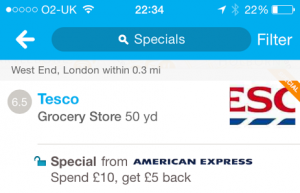

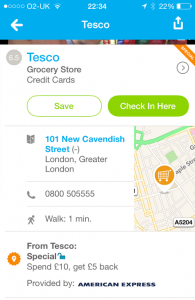

Shop Small is back for another year, starting today and running until 21st December. Like last year, you get £5 back when you spend £10, but unlike last time, there’s no limit on the number of retailers you can go to.

Shop Small is back for another year, starting today and running until 21st December. Like last year, you get £5 back when you spend £10, but unlike last time, there’s no limit on the number of retailers you can go to.

I’ve recently come to the end of my free Sky TV and Broadband subscription (a special offer when Sky bought O2’s home broadband division), so I’ve been on the look out for some great deals for a new plan. I don’t live in a Fibre area (apparently we’re too close to the exchange), so this plan is ADSL.

I’ve recently come to the end of my free Sky TV and Broadband subscription (a special offer when Sky bought O2’s home broadband division), so I’ve been on the look out for some great deals for a new plan. I don’t live in a Fibre area (apparently we’re too close to the exchange), so this plan is ADSL.

If you’ve got a mobile from O2 (or have one of their SIM cards to register the O2 Priority app), you can get a £1 lunch today (and every Monday) thanks to their Priority scheme (available as an app for Android and iOS, and as a web app for Blackberry and Windows Phone).

If you’ve got a mobile from O2 (or have one of their SIM cards to register the O2 Priority app), you can get a £1 lunch today (and every Monday) thanks to their Priority scheme (available as an app for Android and iOS, and as a web app for Blackberry and Windows Phone).

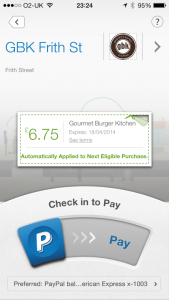

PayPal is

PayPal is