London underground by doug88888

There’s currently two deals on the London Underground to welcome their acceptance of contactless card payments in addition to the Oyster Card.

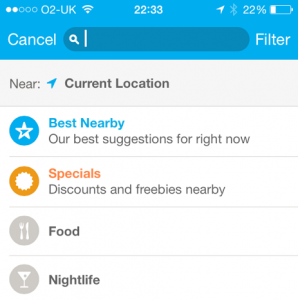

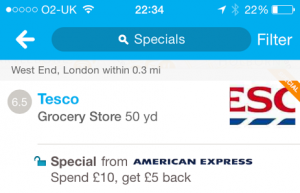

If you’ve got a contactless MasterCard or contactless American Express card, you can get some free travel simply by tapping in using your credit card rather than your Oyster…

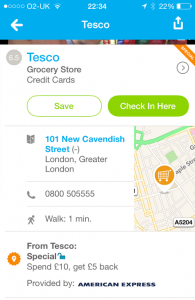

American Express: £5 off when you spend £5

With a contactless American Express card, you can travel around London up to the value of £5. You’ll need to spend £5 in a day, as TfL charge you at the end of each day. Sign up on the Cardmember Offers website, and use your card before 30th November to get your credit

MasterCard: Free travel on Friday 14th November

If you’ve got a contactless MasterCard (remember that the Metro Bank card is a MasterCard debit card), you can get around London completely free simply by tapping in and out using your card this Friday. You don’t even need to register! Full terms available on the MasterCard website

via Londonist

American Express: Drive a car? Get £10 off a £50 at Esso

There aren’t usually that many deals on petrol, so if you drive a car, this one’s for you. Simply sign up on the Cardmember Offers website, fill up with £50 of fuel and you’ll get a £10 credit. It’ll probably work with non fuel items too, if you’ve got one nearby. Expires 24th November

Many of American Express’ cards come with an introductory offer or annual bonus – for example, the

Many of American Express’ cards come with an introductory offer or annual bonus – for example, the  Updated for September 2014

Updated for September 2014 It’s the offer that got me to start this blog, and it was such a great deal that I thought it would never be repeated again… Shop Small from American Express is back this July!

It’s the offer that got me to start this blog, and it was such a great deal that I thought it would never be repeated again… Shop Small from American Express is back this July!