There’s the old adage that “cash is king”, but when it comes to paying for things, as a consumer, it’s much better to pay by credit cards. You’ve got to ensure you’re using them wisely by spending within your means, and make sure you set up a direct debit to pay off the full statement balance each month (and you ensure you’ve got the money in your bank account to pay off your direct debit!).

Here’s ten good reasons to pay by credit card:

1. You get rewards for paying by a cashback/rewards card

There’s a bunch of different reward offers around which give you a credit for simply using the card for your day-to-day transactions: if you’re a member of a frequent flyer/hotel loyalty program, it can be useful to boost your miles or points.

Alternatively, you can earn cashback, usually around 1-1.25%, depending on the card. Watch out for annual fees though, as these will eat into your cashback if you don’t spend enough to make it worthwhile.

2. You have protection if the merchant doesn’t deliver

With a credit card, you have protection in law under Section 75 of the Consumer Credit Act, which makes the credit card company jointly liable with the retailer for transactions over £100 if the company you buy from doesn’t deliver. In practice, this is done through a chargeback through your credit card provider – they will investigate your claim, and then retrieve the money from the merchant’s bank, who will then debit their account, along with a handling fee.

If you’re using a debit card, you should be able to do a chargeback, but this isn’t enshrined in law.

On the other hand, if you’ve paid by cash or cheque, you’ll have to take it up with the merchant and hope you get your money back.

3. You get a record of where you’re spending your money

Your online statement is a great way to work our where you spent your money – it’s unlikely that you’re keeping a record of where you are spending all those cash withdrawals, right?

4. You’ll build your credit rating

Paying off your credit card on time helps to build your credit rating – this shows lenders that you’re a good credit risk, and should help you get credit in the future.

5. You get a ‘float’ period

You get up to around two months interest free credit. This is the period in between spending on the card, receiving the bill, and the money coming out through the direct debit. You can earn interest on this money if you’re using a top current account, like the Santander 123 Current Account.

6. If you’re spending overseas using a 0% fee card, you’ll get an unbeatable exchange rate

See more information about this in my Foreign Spending blog post

There are currently a number of cards that allow you to do this – both credit and debit, such as the Halifax Clarity Credit Card, or a Metro Bank Debit Card.

The benefit of using these cards abroad is that you’ll benefit from the interbank exchange rate, rather than the tourist one which is always a couple of points in their favour. Just watch out for dynamic currency conversion – this is when the machine will ask if you want to pay in Pounds rather than the foreign currency: you should always reject this offer.

7. Contactless is faster than cash

It’s a lot easier to pay by contactless than it is to by cash – you don’t need to fumble with change. In London, it’s accepted at a load of retailers – mainly chains, but they’re starting to roll it out. Plus it’s now cheaper to use your contactless card on the bus than paying by cash if you forget your Oyster.

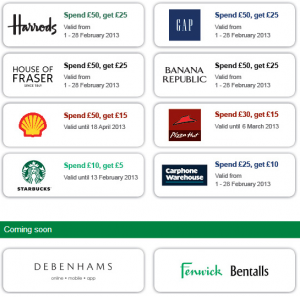

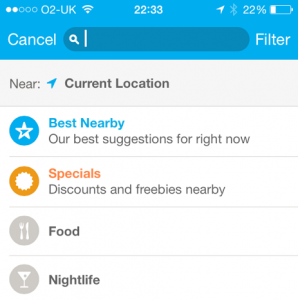

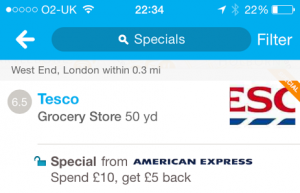

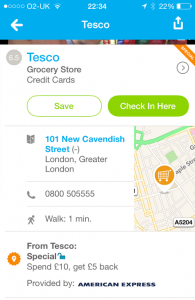

8. You can occasionally get exclusive rewards and offers

If you’ve looked at my blog recently, you’ll have seen the multitude of offers that have been available for American Express card holders – whilst this isn’t a guarantee that they’ll come back again, there’s usually an offer or two about.

9. If you’re defrauded, there won’t be a hold on your funds

In the unlikely event that you do get defrauded, it’s the credit card company’s funds – if you were using a debit card, there’s the possibility that you could be without cash.

10. If you lose your card, you can get a free replacement

If you lose your cash, it’s gone – lose your card, and you’ll get a free replacement: and some card companies will even courier you a temporary card if you’re abroad

Of course, there’s some places that are cash only, but with the introduction of credit card payment machines that fit into smartphones such as iZettle, Square, mPowa, SumUp and PayPal Here, in the future, we’ll be paying by cash a lot less (on a side note, I have a card reader, so if you owe me money, you can now pay by credit card!)

So, ditch your cash and debit card, and use your credit card for all your purchases.

Many of American Express’ cards come with an introductory offer or annual bonus – for example, the

Many of American Express’ cards come with an introductory offer or annual bonus – for example, the  Updated for September 2014

Updated for September 2014 It’s the offer that got me to start this blog, and it was such a great deal that I thought it would never be repeated again… Shop Small from American Express is back this July!

It’s the offer that got me to start this blog, and it was such a great deal that I thought it would never be repeated again… Shop Small from American Express is back this July!